Rigorous Expense Management Software Market Industry Analysis provides the strategic intelligence required for effective decision-making by vendors developing competitive strategies and organizations evaluating expense management investments. This analysis encompasses market sizing, competitive dynamics, technology trends, customer requirements, and regulatory factors that together characterize the expense management software industry landscape. The Expense Management Software Market size is projected to grow USD 16.89 Billion by 2035, exhibiting a CAGR of 11.80% during the forecast period 2025-2030. This substantial growth projection creates opportunities for well-positioned participants while intensifying competitive pressure that challenges vendors to continuously innovate and deliver superior value. Industry analysis methodology combines quantitative market data with qualitative insights gathered from customer interviews, vendor briefings, and expert consultations to provide comprehensive perspective on market dynamics. The resulting intelligence informs strategic decisions regarding product development priorities, market positioning, partnership strategies, and investment allocation across the expense management software ecosystem.

The competitive landscape analysis examines vendor positioning, differentiation strategies, and competitive dynamics across market segments. Market leadership positions are contested among enterprise software giants offering expense management as integrated components of financial management suites and specialized vendors focused exclusively on expense management excellence. Differentiation strategies vary, with some vendors competing primarily on functional completeness while others emphasize ease of use, implementation speed, or pricing competitiveness. Geographic positioning differs among vendors, with some maintaining global presence while others focus on specific regions where they can establish dominant positions. Vertical market specialization is emerging as vendors develop industry-specific capabilities addressing unique requirements in sectors including healthcare, construction, and professional services. Partnership strategies are increasingly important as vendors build ecosystems that enhance their solutions through complementary capabilities and extend their reach through channel relationships.

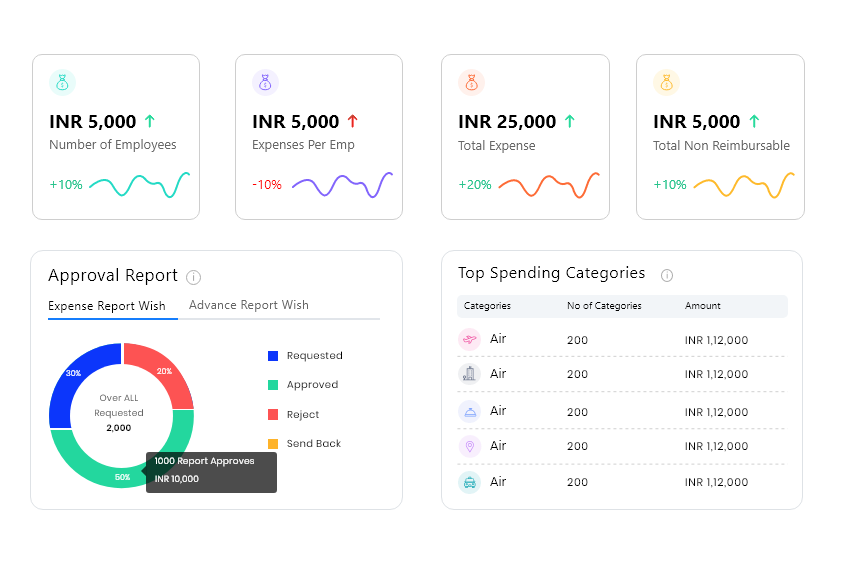

The customer requirements analysis identifies the priorities driving expense management software evaluation and selection decisions. Automation capability has emerged as the primary requirement as organizations seek solutions that minimize manual effort through intelligent processing of expenses from capture through reimbursement. Integration flexibility is essential as organizations require expense management solutions that connect seamlessly with existing corporate systems including accounting platforms, card programs, and travel management tools. Mobile experience quality directly impacts user adoption and value realization, making mobile capability a critical evaluation criterion. Analytics and reporting capabilities enable organizations to gain insights from expense data that inform budget management, vendor negotiation, and policy optimization. Implementation simplicity influences selection particularly among mid-market and small business buyers seeking rapid deployment without extensive consulting engagement.

The strategic implications of industry analysis inform action planning for both vendors and buyers in the expense management software market. Vendors should prioritize artificial intelligence capabilities that differentiate through automation excellence and position for long-term competitive advantage. Integration investment is essential as ecosystem connectivity increasingly determines solution attractiveness for enterprise buyers. Customer success focus differentiates vendors in a market where implementation quality significantly impacts realized value and influences reference potential. Pricing strategy must balance revenue optimization against competitive pressure and market penetration objectives, particularly for vendors pursuing small and medium business segments. Buyers should prioritize solutions demonstrating innovation trajectory that will continue advancing capabilities over the expected deployment lifetime. Integration requirements should be thoroughly validated before selection to avoid post-implementation discovery of connectivity limitations that constrain value realization.

Top Trending Reports -

UK Railway Cybersecurity Market Size

Germany Operational Technology Security Market Size

Japan Operational Technology Security Market Size